As the world steps out of a pandemic and into a post-pandemic phase, the rebounding of economies is returning, but slower than perhaps expected. Issues like war and inflation have complicated recovery and affect consumer demand in various segments. Optimistic outlooks estimate the market downturn may start to rise in the second half of the year. For the memory market, the continuation of price decreases do not reinforce an optimistic return to standard operating procedure. While the demand for consumer-oriented ICT products remain sluggish, the industrial-grade segments such as the server market continue to be the driving force.

Here are some updates and price projections for three major applications in memory market.

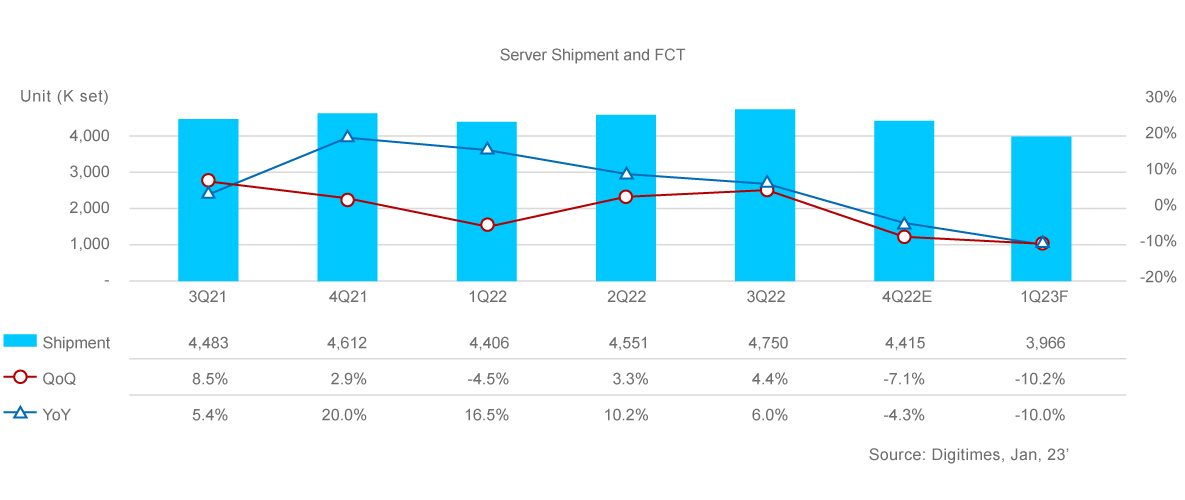

Server Market

“Global business down makes low demand in CSP“

Q1, 23’ Demand & Supply

- Top 4 Data Center demand for Mega, Apple, Microsoft, Amazon and Alphabet (MAMAA) expected to decline 5% to 10% in Q1

- China branded server demand is slow with Inspur dropping 9% in Q1

- No major parts shortage from supplier side

Q2, 23’ Pricing Outlook in Server DIMM

- The cost of low-density 16GB/32GB has reached its bottom, leaving no room to lower the price

- Mid-density 64GB still offers partial concession by demand

- High-density 128GB is expected to remain stable since supply is under control

PC/NB Market

“Production cut yet makes result, gloomy in Q2’”

Q1, 23’ Demand & Supply

- Avg. days of sales inventory is 7-10 weeks. DRAM is approximately 12 weeks while SSD falls to 7 weeks. Still slow moving

- Negative factors like unsold inventory, high unemployment, prudent investment and downsizing impact the demand of all new business (N/B) segments

Q2, 23’ Pricing Outlook for PC/NB DIMM

- PC DIMMs sales are down 50% compared to last year. The range of decline seems to have stabilized

- Contract price may drop 7%-10% in Q2. Spot price is mostly the same as contract price, suggesting that the downstream inventory is health

- Inventory pressure still exists for mid-stream (NB OEM) and original supplier

Mobile Market

“2023 Smartphone expects to decline 1%, recovery is foresaw in 2024”

- Global smartphones low shipments and traditional off-season make NAND wafers consumption even slower. The supply-demand ratio in Q2, 23' will reach its peak, and is expected to result in another decline in chip prices

- In the NAND outlook, the Enterprise SSD is down over 15% in Q1, 23’. However, the price reduction could be controlled to a 10% decrease since suppliers have endured the impact of margin loss from other Flash segments as well as the effect of CapEx control

- Client SSD market declined 15% in Q1, 23’, which is expected to continue as the end user market remains weak. The price decrease has impacted the cash cost to suppliers. The suppliers are anticipated to tighten production from wafers to modules, resulting in a moderate decline between 5-8%

*This article was compiled by SMART Modular using data sources from market reports by TrendForce, DIGITIMES, and IDC.