NEWARK, CA – October 1, 2020 – SMART Global Holdings, Inc. (“SMART” or the “Company”) (NASDAQ: SGH), today reported financial results for the fourth quarter and full year fiscal 2020 ended August 28, 2020.

Fourth Quarter Fiscal 2020 Highlights:

- Net sales of $297.0 million, 6.7% higher than the year ago quarter.

- GAAP net income of $7.5 million, or $0.30 per share, 33.8% and 28.3% higher than the year ago quarter, respectively.

- Non-GAAP net income of $20.4 million or $0.82 per share, 72.2% and 65.2% higher than the year ago quarter, respectively.

- Adjusted EBITDA of $33.0 million, 30.6% higher than the year ago quarter

Full Year Fiscal 2020 Highlights:

- Net sales of $1.1 billion, versus $1.2 billion for the prior fiscal year.

- GAAP net loss of $1.1 million, or $0.05 per share.

- Non-GAAP net income of $63.7 million, or $2.59 per share.

- Adjusted EBITDA of $104.2 million.

- Ending cash and equivalents balance exceeded $150 million.

"I am pleased to announce a strong conclusion to our fiscal 2020,” commented Mark Adams, President and CEO. “Our fourth fiscal quarter results demonstrate the strength of our business during these challenging times. Fourth quarter revenue grew by 5.6 percent sequentially, driven by strength in both our Specialty Compute and Storage Solutions and Brazil businesses. Additionally, reflecting the operating leverage in our business model, we achieved non-GAAP earnings per share of $0.82, more than 17 percent higher than the previous quarter."

"Given our strong balance sheet, we believe we are well-positioned to build on our growth and diversification strategy while leveraging our strong customer relationships, established global manufacturing and supply chain capabilities, and our track record of operational excellence," concluded Mr. Adams.

| Quarterly Financial Results (In millions, except per share amounts) |

||||||

|---|---|---|---|---|---|---|

| GAAP1 | Non-GAAP2 | |||||

| Q4 FY20 | Q3 FY20 | Q4 FY19 | Q4 FY20 | Q3 FY20 | Q4 FY19 | |

| Net Sales | $ 297.0 | $ 281.3 | $ 278.4 | $ 297.0 | $ 281.3 | $ 278.4 |

| Gross Profit | $ 56.3 | $ 54.2 | $ 52.3 | $ 57.8 | $ 55.9 | $ 53.4 |

| Operating Income | $ 17.2 | $ 10.1 | $ 11.4 | $ 28.4 | $ 20.3 | $ 18.0 |

| Net Income | $ 7.5 | $ 0.8 | $ 5.6 | $ 20.4 | $ 17.1 | $ 11.9 |

| Diluted Earnings Per Share (EPS)3 | $ 0.30 | $ 0.03 | $ 0.24 | $ 0.82 | $ 0.70 | $ 0.50 |

| Annual Financial Results (In millions, except per share amounts) |

||||

|---|---|---|---|---|

| GAAP1 | Non-GAAP2 | |||

| FY20 | FY19 | FY20 | FY19 | |

| Net Sales | $ 1,122.4 | $ 1,212.0 | $ 1,122.4 | $ 1,212.0 |

| Gross Profit | $ 216.4 | $ 237.5 | $ 222.3 | $ 240.6 |

| Operating Income | $ 41.3 | $ 89.1 | $ 84.2 | $ 113.2 |

| Net Income | $ (1.1) | $ 51.3 | $ 63.7 | $ 78.3 |

| Diluted Earnings Per Share (EPS)3 | $ (0.15) | $ 2.19 | $ 2.59 | $ 3.34 |

(1) GAAP represents U.S. Generally Accepted Accounting Principles.

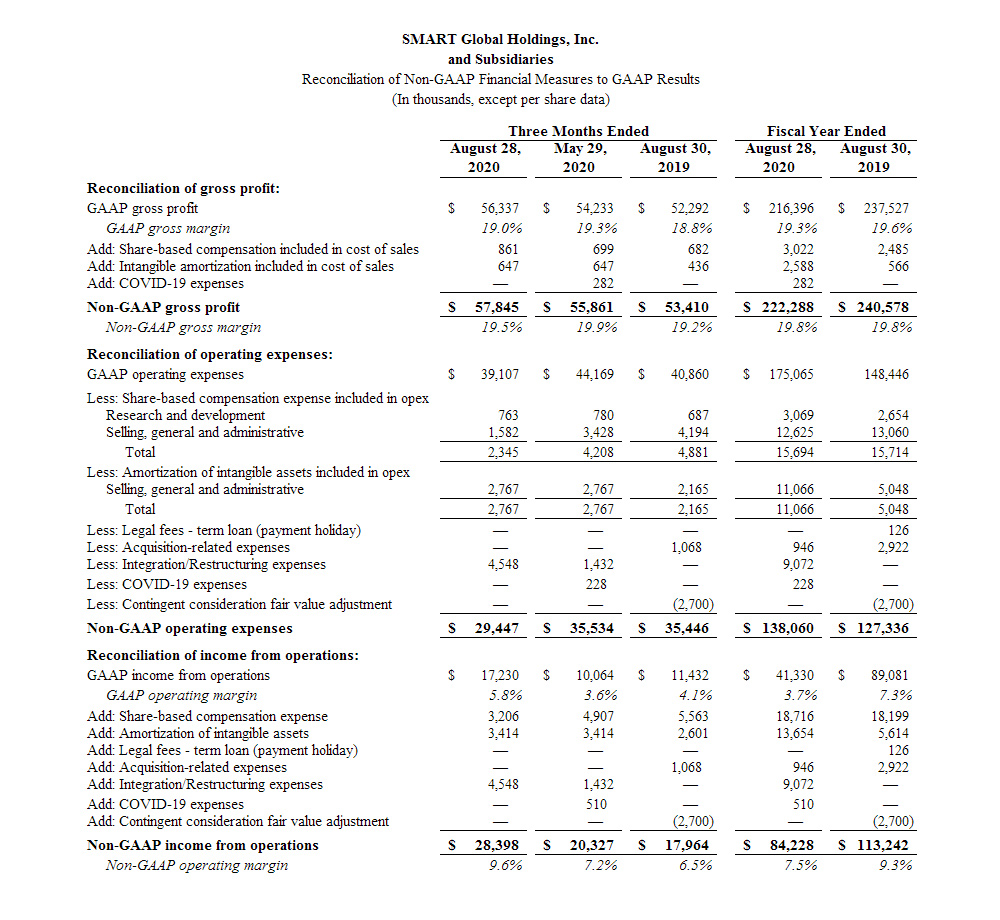

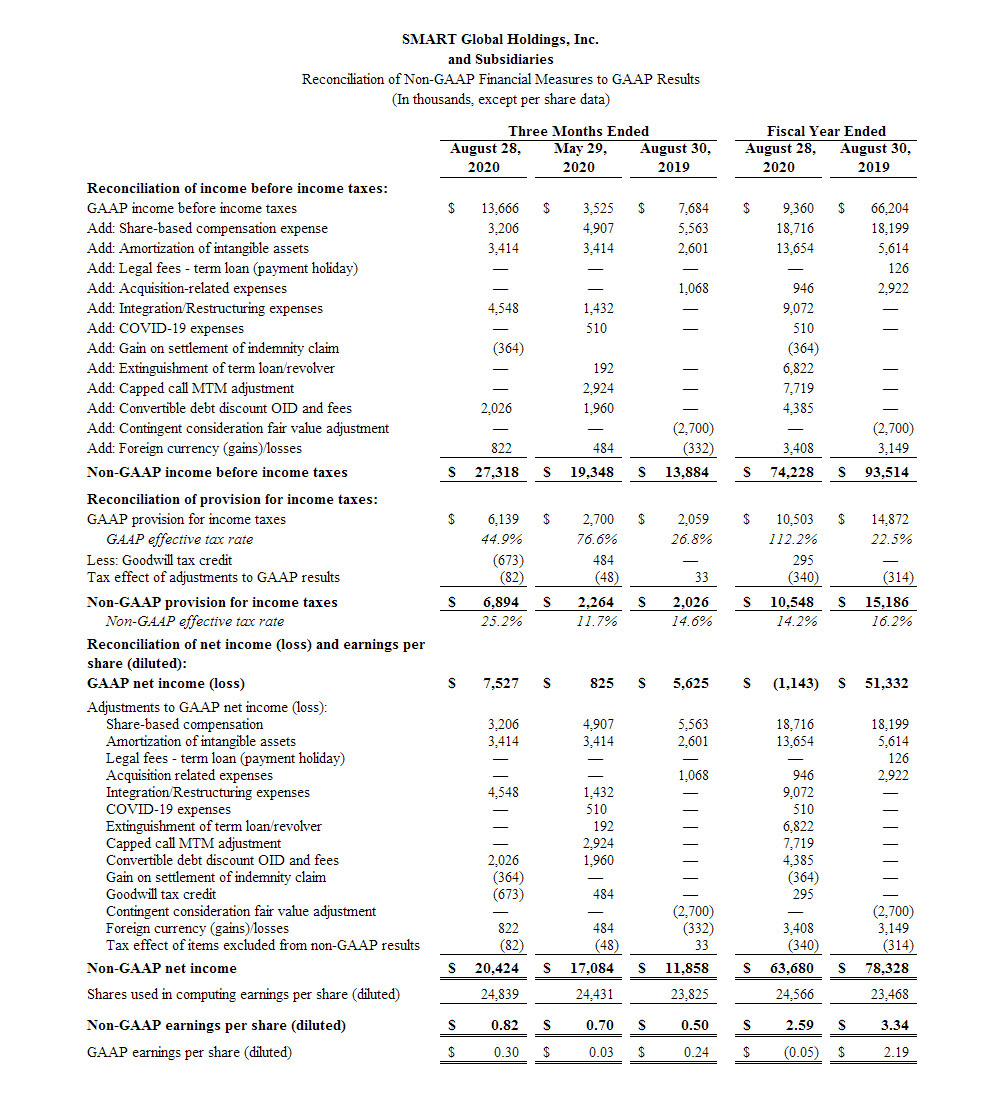

(2) Please refer to the "Non-GAAP Information" section and the "Reconciliation of Non-GAAP Financial Measures" tables below for further detail on the non-GAAP financial reporting referenced above and a reconciliation of such measures to our nearest GAAP measures.

Business Outlook

The following statements are based upon management's current expectations for the first quarter of fiscal 2021 ending November 27, 2020. These statements are forward-looking and actual results may differ materially. SMART undertakes no obligation to update these statements.

| Net Sales - GAAP/Non-GAAP | $280 to $300 Million |

| Gross Margin - GAAP/Non-GAAP | 18% to 19% |

| Diluted EPS - GAAP | $0.28 ± $0.05 |

| Share-Based Compensation Per Share | $0.20 |

| Intangible Amortization Per Share | $0.14 |

| Convertible Debt Discount OID and Fees Per Share | $0.08 |

| Diluted EPS - Non-GAAP | $0.70 ± $0.05 |

| Expected Dilute Share Count | 25.0 Million |

Conference Call Details

SMART will host a conference call today for analysts and investors at 1:30 p.m. Pacific Time, 4:30 p.m. Eastern Time. Dial-in US toll free +1-866-487-6452, or International toll free +1-213-660-0710 using access code 4779109. We will post an accompanying slide presentation to our website prior to the beginning of the call.

A replay of the conference call will be available for one week following today’s call through the Events section of the SMART website at www.smartgh.com or by calling US toll free +1-855-859-2056, or International toll free +1 404-537-3406; Passcode: 4779109.

Forward-Looking Statements

This release contains, and statements made during the above-referenced conference call will contain "forward-looking statements" including among other things, statements regarding future events and the future financial performance of SMART (including the business outlook for the next fiscal quarter) and statements regarding growth drivers in SMART’s industries and markets. These statements are only predictions and may differ materially from actual future events or results due to a variety of factors, including but not limited to: business and economic conditions and growth trends in the technology industry, our customer markets and various geographic regions; global economic conditions and uncertainties in the geopolitical environment; disruptions in our operations or in global markets as a result of the outbreak of COVID-19; changes in trade regulations or adverse developments in international trade relations and agreements; changes in currency exchange rates; overall information technology spending; appropriations for government spending; the success of our strategic initiatives including additional investments in new products, additional capacity and acquisitions; the DRAM market and the temporary and volatile nature of pricing trends; deterioration in customer relationships; production or manufacturing difficulties; competitive factors; technological changes; difficulties with or delays in the introduction of new products; slowing or contraction of growth in the memory market in Brazil; reduction in or termination of incentives for local manufacturing in Brazil; changes to applicable tax regimes or rates; prices for the end products of our customers; fluctuations in material costs and availability; strikes or labor disputes; deterioration in or loss of relations with any of our limited number of key vendors; changes in the availability of supply of materials, components or memory products; the inability of Penguin Computing to obtain and retain security clearances to expand its government business; and other factors and risks detailed in SMART’s filings with the Securities and Exchange Commission. Such factors and risks as outlined above and in such filings may not constitute all factors and risks that could cause actual results of SMART to be materially different from the historical results and/or from any future results or outcomes expressed or implied by such forward-looking statements. SMART and its subsidiaries operate in a continually changing business environment and new factors emerge from time to time. SMART cannot predict such factors, nor can it assess the impact, if any, from such factors on SMART or its subsidiaries’ results. Accordingly, investors are cautioned not to place undue reliance on any forward-looking statements. Forward-looking statements should not be relied upon as a prediction of actual results. These forward-looking statements are made as of today, and SMART does not intend, and has no obligation, to update or revise any forward-looking statements in order to reflect events or circumstances that may arise after the date of this press release, except as required by law.

Non-GAAP Information

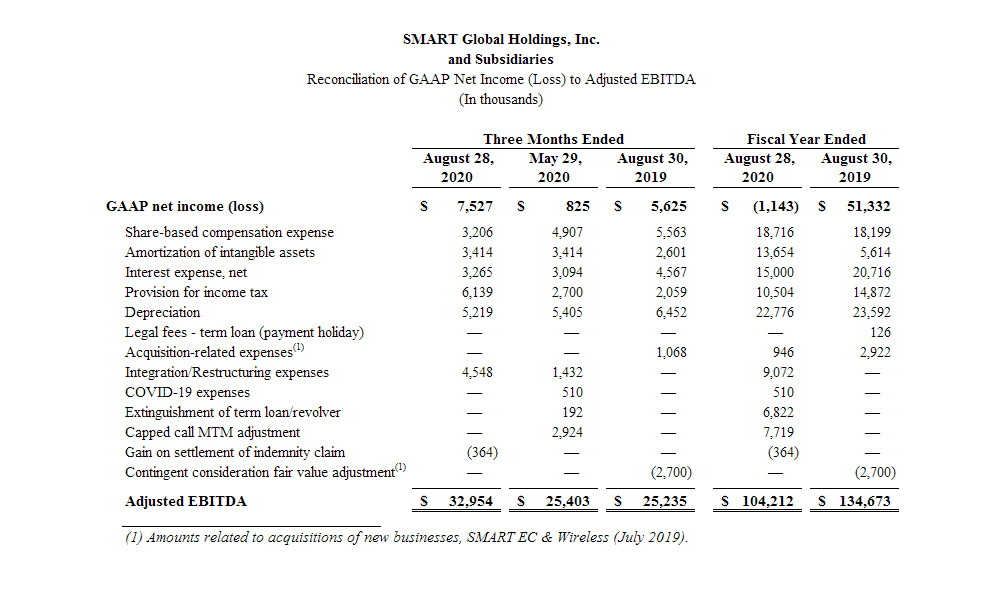

Certain non-GAAP financial measures are contained in this press release or will be discussed on our conference call, including non-GAAP gross profit, non-GAAP operating income, Adjusted EBITDA, non-GAAP net income, and non-GAAP net income per diluted share. We define Adjusted EBITDA as GAAP net income (loss) plus net interest expense, income tax expense, depreciation and amortization expense, share-based compensation expense, loss on extinguishment of debt/revolver, capped call mark to market (MTM) adjustment, restructuring expenses, integration expenses, COVID-19 expenses, acquisition-related expenses, gain on settlements and other infrequent or unusual items. Adjusted EBITDA is not a measure of financial performance calculated in accordance with U.S. GAAP and should be viewed as a supplement to, not a substitute for, our results of operations presented on the basis of U.S. GAAP. Adjusted EBITDA also does not purport to represent cash flow provided by, or used in, operating activities in accordance with U.S. GAAP and should not be used as a measure of liquidity.

The non-GAAP financial results presented herein exclude share-based compensation expense, intangible amortization expense, loss on extinguishment of debt/revolver, capped call MTM adjustment, convertible debt original issue discount (OID) and fees, restructuring expenses, integration expenses, COVID-19 expenses, acquisition-related expenses, gain on settlements and other infrequent or unusual expenses, and with respect to non-GAAP diluted EPS, foreign currency gains (losses). These non-GAAP financial measures are provided to enhance the user's overall understanding of our financial performance. By excluding these charges, as well as any related tax effects, our non-GAAP results provide information to management and investors that is useful in assessing SMART's core operating performance and in evaluating and comparing our results of operations on a consistent basis from period to period. These non-GAAP financial measures are also used by management to evaluate financial results, to plan and forecast future periods, and to assess performance of certain executives for compensation purposes. The presentation of this additional information is not meant to be a substitute for the corresponding financial measures prepared in accordance with U.S. GAAP. In addition, these measures may not be used similarly by other companies and therefore may not be comparable between companies.

Investors are encouraged to review the “Reconciliation of Non-GAAP Financial Measures to GAAP Results” and “Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA” tables below for more detail on non-GAAP calculations.

About SMART Global Holdings

The SMART lines of business are leading designers and manufacturers of electronic products focused on memory and computing technology areas. The Company specializes in application specific product development and support for customers in enterprise, government and OEM sales channels. Customers rely on SMART as a strategic supplier with top tier customer service, product quality, and technical support with engineering, sales, manufacturing, supply chain and logistics capabilities worldwide. The Company targets customers in markets such as communications, storage, networking, mobile, industrial automation, industrial internet of things, government, military, edge computing and high performance computing. SMART operates in three primary product areas: Specialty Memory products, Brazil products and Specialty Compute and Storage Solutions.

For more information about SMART Global Holdings business units, wisit:, SMART Modular Technologies, SMART Embedded Computing, SMART Supply Chain Services and Penguin Computing for more information.

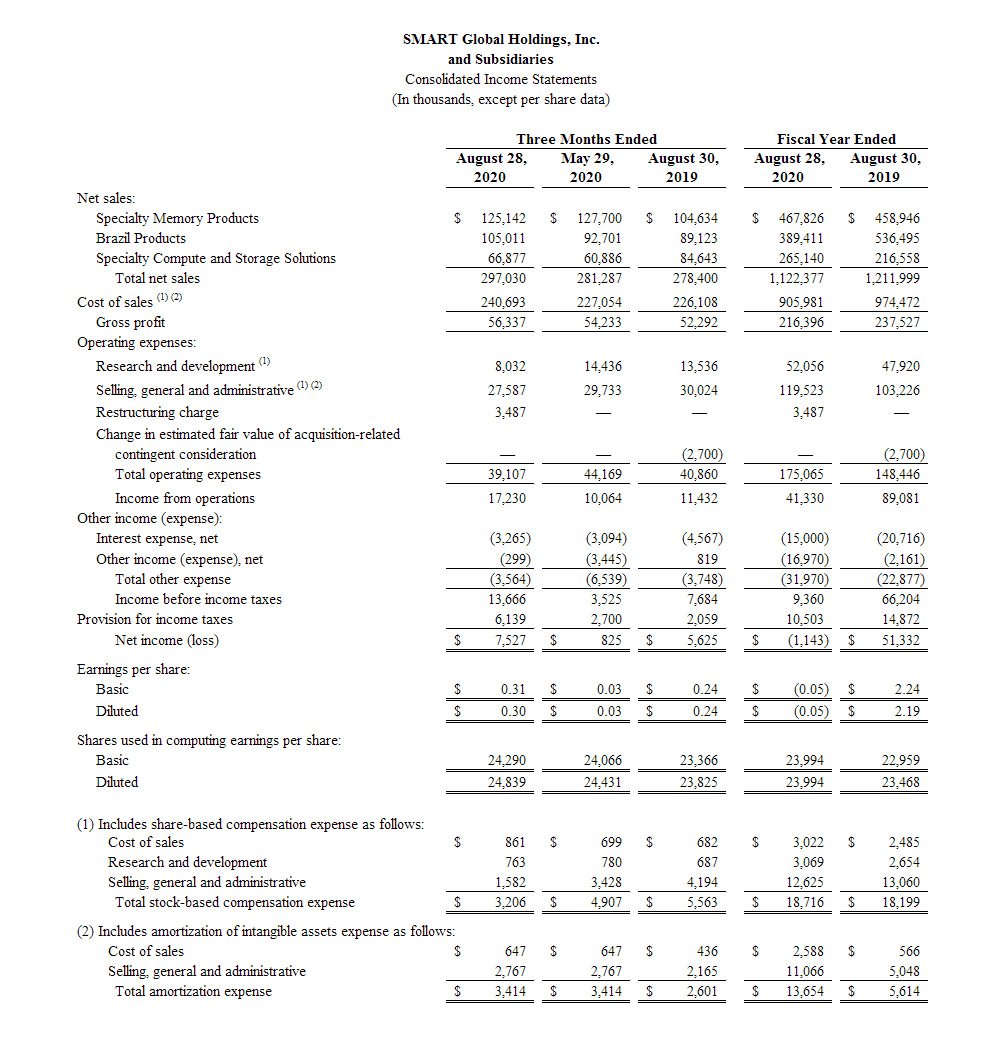

Consolidated Statements of Income

Reconciliation of Non-GAAP Financial Measures to GAAP Results

Reconciliation of Non-GAAP Financial Measures to GAAP Results (continued)

Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA

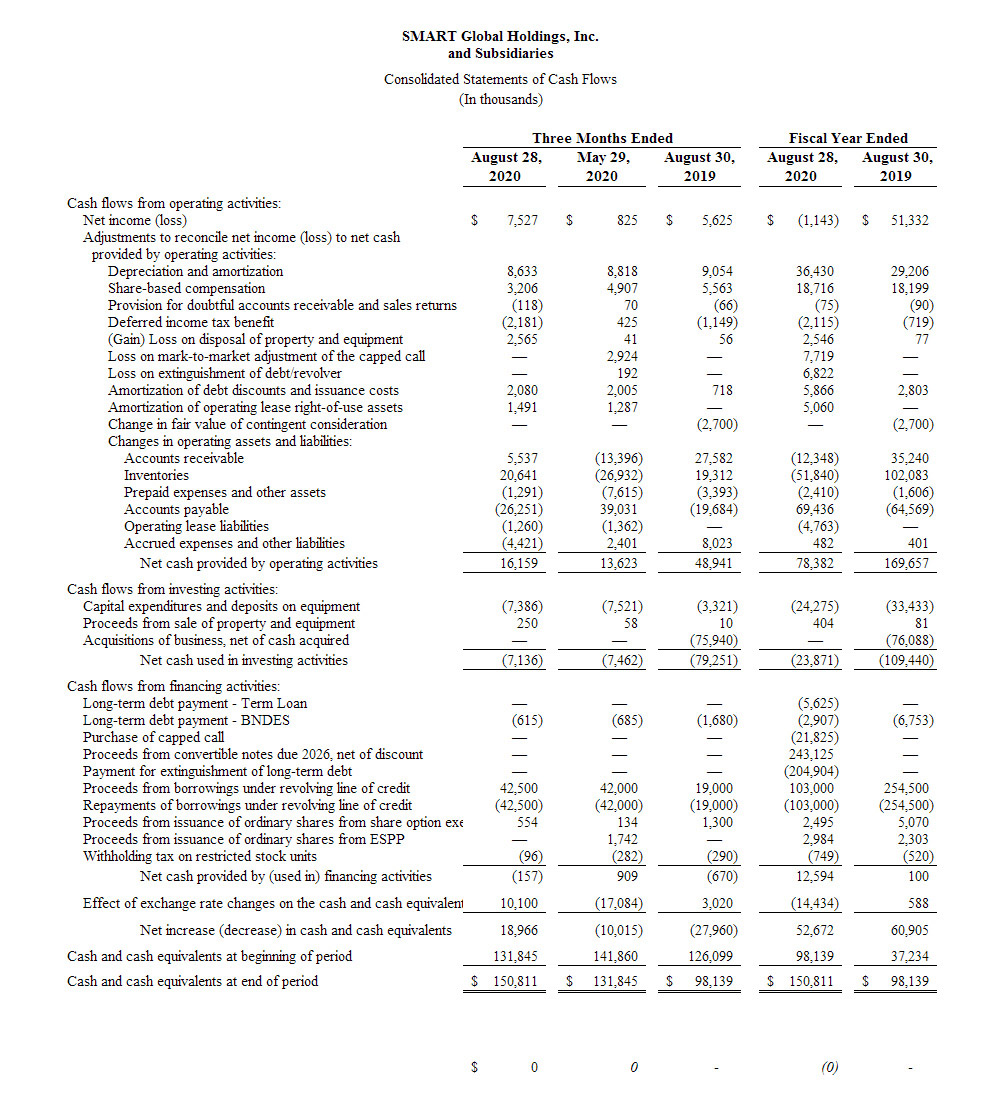

Consolidated Statements of Cash Flows

# # #

Investor Contact:

Suzanne Schmidt

Investor Relations for SMART Global Holdings, Inc.

(510) 360-8596

ir@smartm.com